NON-RESIDENTE TAX

MODEL 210

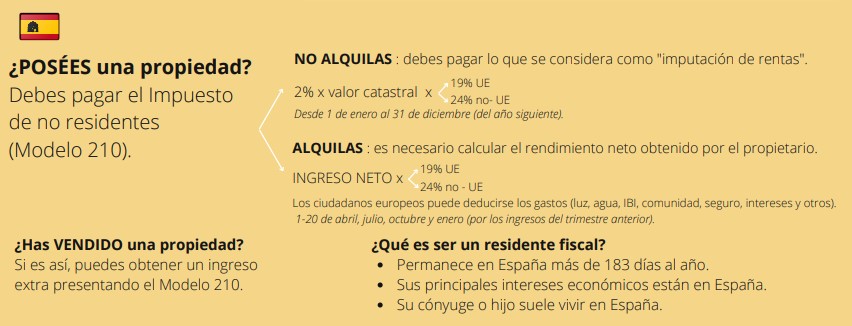

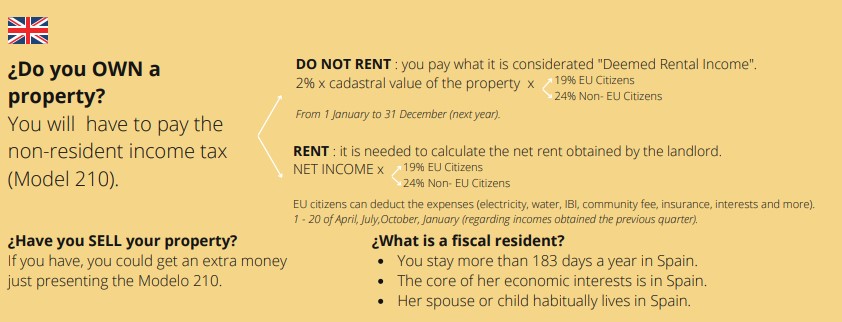

Even if you do not live in Spain all year round, it is necessary for you to know that if you have BOUGHT A HOUSE in Spain you must pay several taxes, among them the non-resident income tax (IRNR). But, what does it mean to be a NON RESIDENT TAXPAYER in Spain?

In order to understand this concept we must go to the definition of TAX RESIDENT:

- Staying in Spain for more than 183 days per year.

- The main nucleus or base of its activities or economic interests is located in Spain, either directly or indirectly.

- That the spouse who is not legally separated and the minor children who depend on this individual habitually reside in Spain. This third assumption admits proof to the contrary.

Therefore, all those persons who are not tax residents in Spain will be considered, in their absence, as NON tax residents and will have to comply with the tax obligations of NON residents, among them, to pay taxes on their income obtained in Spain.

For instance, a couple, with fiscal residence in Belgium, decides to buy on January 1, 2022 an apartment in Malaga to come on their vacations. There can be two scenarios: that the couple decides not to rent it and only enjoy it when they come on their vacations or that they decide to rent it in those months when the apartment is empty.

DO NOT RENT THE APPARTMENT

En el caso, en que ellos decidan no alquilar la vivienda y tenerla a su entera disposición todo el año, al tratarse de una segunda residencia, dado que su residencia principal se encuentra en Bélgica, deben pagar lo que se conoce en España como IMPUTACIÓN DE RENTAS.

¿What is the "Deemed Rental Income"?

Imputed real estate income is considered to be the income that the taxpayer must attribute to himself as owner of a property, provided that the property does not generate income from real estate capital and is not used for economic activities. In other words, it is a "fictitious" income attributed to the owner for having the right to use the property.

Continuing with our example, the Belgian couple, being non-resident taxpayers, are obliged to pay the Non-Resident Income Tax (form 210). They will have the whole calendar year 2023 to file and pay this tax.

It is important to take into account that for parking lots, storage rooms, boat docking, among others, income imputation must also be paid.

RENT THE APPARTMENT

In the event that the Belgian couple decides to rent the property, for example, through Airbnb or a real estate agency, they will have to pay taxes on the income obtained from renting the property.

The 210 form must be filed every quarter and include the income received in that quarter. As they are citizens with tax residence in the EU, they will be able to deduct the expenses incurred in the rent, for example, agency fees, management fees, community fees... We remind you that non-European citizens do not have this tax benefit, and cannot deduct any expenses, a benefit that UK citizens have lost.

Below you will see a summary:

If you have purchased a property in Spain, please contact us and we will advise you on your tax obligations.